Variable insurance policy plan was first promoted in 1976, and varying universal lifestyle policies (VUL) were released in the Nineteen-eighties. However, VUL did not take off in popularity until the 90's and income have been up and down as the stock markets have gone through bull and bear periods. According to LIMRA, in 2014 VUL income were up, but still only showed about 6% of all insurance policy plan premium promoted.

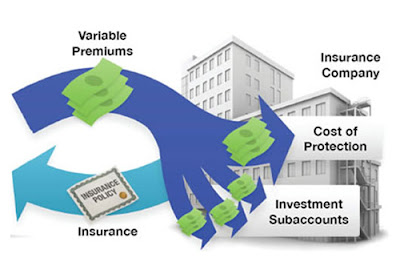

VUL a permanent insurance plan coverage coverage that builds money value, has flexible premiums and allows for loans. VUL also offers the plan proprietor the potential to earn better pay of return. Unlike whole and universal lifestyle policies that spend the money value in a fixed account, VUL allows the plan proprietor to spend in a selection of common finance subaccounts. Mutual finance subaccounts are essentially clones of retail common finance shares offered in insurance plan coverage and annuity products.

With VUL, the plan proprietor controls the allowance and chooses how and when to get the money value into the subaccounts or a fixed consideration. Most guidelines do place limitations on exchanges in and out of the set consideration (unless it part of an automated money price calculating program) and boundaries on regular exchanges between subaccounts. If the investment strategies don’t provide an acceptable come back, the plan proprietor may have to make additional top quality expenses and/or reduce the loss of life benefit to keep the plan from lapsing. If the plan is properly handled, the money value can develop, and withdrawals can be taken from the plan as low-cost loans and/or tax-free restoration of rates paid (cost basis). Distributions may be restricted and susceptible to with drawl or give up expenses.

As long as the plan remains in power any admiration or earnings in the subaccounts is not susceptible to taxes. However, if the plan drops, any withdrawals, more than the price foundation, would be susceptible to taxes as everyday earnings. Consequently, the plan proprietor, rather than the insurance provider, is taking all the investment risk, since there are no assures.

0 comments:

Post a Comment

Thanks For Your Feed Back